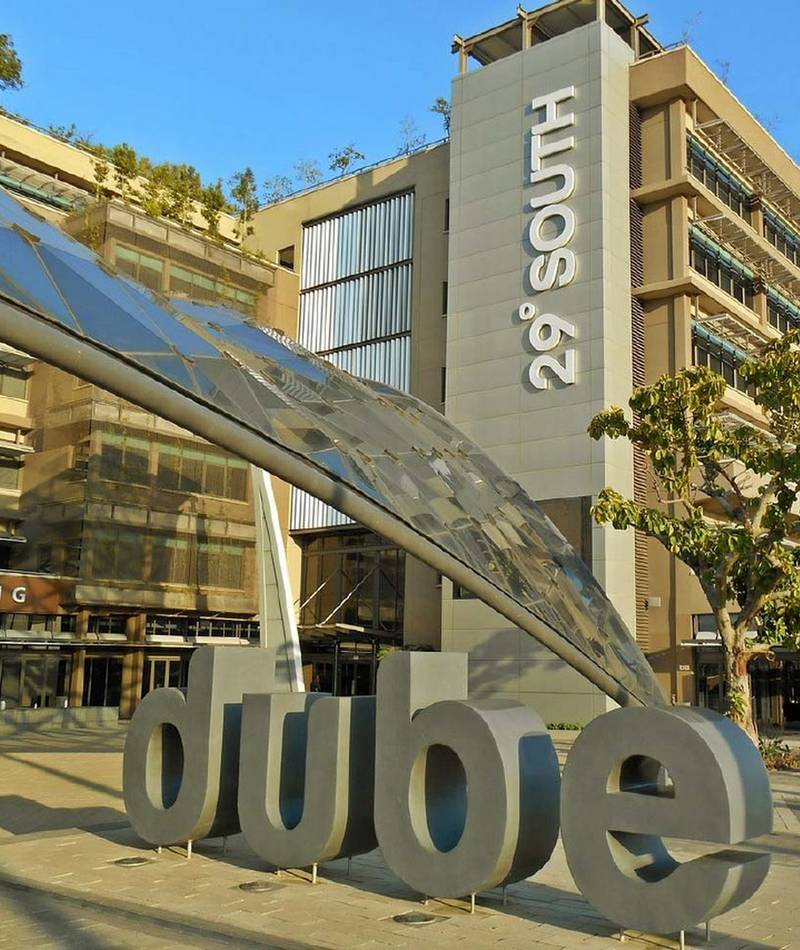

Our New Plant - Durban, South Africa

Our new state of the art plant set to be based in Dube Trade Port Economic Zone in Durban will showcase our unique proudly South African Technology in the upgrading of low-grade minerals to pharmaceutical and battery grade additives and metals including lithium and zinc. Together with our technical, operations and logistics teams, we aim to create 50 new jobs in the first year of operation. Part of our development initiative is to run an intern learnership programme at Gemtoll SA to assist young ambitious process technicians in developing themselves via the mentorship of our highly skilled leadership team.

Why the Economic Industrial Development Zone?

Government trade and industry have identified IDZs as the most effective way to grow the South African economy. The special economic zones are also crucial in the job creating drive which remains high on government’s agenda. The government plans to intensify its approach to industrialise South Africa’s economy as demanded by the National Development Plan (NDP).Situated at the heart of King Shaka International Airport, the Dube TradePort IDZ is set to transform Kwazulu-Natal into both a key business gateway and a noteworthy player in the global supply chain of goods. Two investment areas will be crucial in the success of the IDZ and they are the Dube TradeZone, and the Dube AgriZone. What makes the IDZs unique is that they offer a variety of incentives for investors, including a 15 percent corporate tax rate, employment tax as well as duty free on imported equipment.

Dube TradeZone – aims to focus on manufacturing and value-addition primarily for automotive, electronics and fashion garments. The facility involves warehousing, manufacturing, assembling real estate resource, complete with a single facility in which all freight forwarders and shippers are located (Dube Trade House), which enjoys a direct link to the adjacent Dube Cargo Terminal via an elevated cargo conveyor system.

Special Economic Zone Fund

Given longer term funding constraints, the SEZ Act and the SEZ draft strategy encourages the private sector to play an active role in the South African Special Economic Zones Programme. The SEZ Act envisages public private partnerships in the development and operation of Special Economic Zones.This offers the potential for a number of different models involving:

- Assembly of land parcels with secure title and development rights by the government for lease to private zone development groups;

- Build – operate- transfer approaches to onsite zone infrastructure and facilities with government guarantees and/or financial support;

- Contracting private management for government owned zones or lease of government owned assets by a private operator.

A SEZ fund intends providing multi-year funding for SEZ infrastructure and related operator performance improvement initiatives aimed at accelerating growth of manufacturing and internationally traded service operations, to be located within the designated zones.

The primary objective is to provide capital towards bulk and related infrastructure that leverages investment from third parties, through foreign and local direct investment in both the operations of such enterprises and the infrastructure required. A secondary focus is to provide limited operator and investor project financial and advisory support to affirm the feasibility of such projects and for work that will measurably improve the efficiency and effectiveness of SEZs to improve the competitiveness and sustainability of SEZ’s and their supply chains.

This industrial infrastructure is expected to leverage FDI and private investment and achieve:

- Increased exports of value-added products

- Measurable improvement in levels of localisation and related value chains

- Increased beneficiation of mineral and agricultural resources

- Increased flow of foreign direct investment

- Increased job opportunities; and

- Creation of industrial hubs, clusters and value chains in underdeveloped areas.

The tax incentives for qualifying companies include: VAT and customs relief, if located within a Customs-Controlled Area (CCA); the employment tax incentive; building allowance; and reduced corporate income tax rate.

Characteristics of a CCA include:

- Import duty rebate and VAT exemption on imports of production-related raw materials, including machinery and assets, to be used in production with the aim of exporting the finished products;

- VAT suspension under specific conditions for supplies procured in South Africa; and

- Efficient and expedited customs administration.